How to transfer money from PayPal to Webmoney so that the transaction is successful? There are a number of functions within payment systems that allow you to conduct transactions between wallets, taking into account a favorable rate. Currency exchange in the banking system provides the ability to link cards, replenish wallets and pay for other services.

How to withdraw money from PayPal wallet to Webmoney account?

In the Webmoney payment system, it was previously not possible to withdraw funds without contacting Internet exchangers that charged interest for each transaction. Now the English currency exchange works with the American banking PayPal.

As you know, PayPal allows you to link a bank account or card to withdraw funds and replenish the balance of your e-wallet.

- Within the Webmoney system, users who want to transfer money to a wallet with PayPal must create an application.

- It is formed in the "Applications" section.

- The program sets the wallet numberautomatically - the WM wallet that is available as part of a currency transaction is selected.

- PayPal account is not charged commission, unlike owners of WM-wallets.

As soon as the application is approved, you need to enter the amount. Additionally, a note and ways of contacting the account holder in the WM system are indicated. You can set visibility options as you wish. If the amount is large, the participants in the transaction can protect it from prying eyes by hiding the task from the list of available ones.

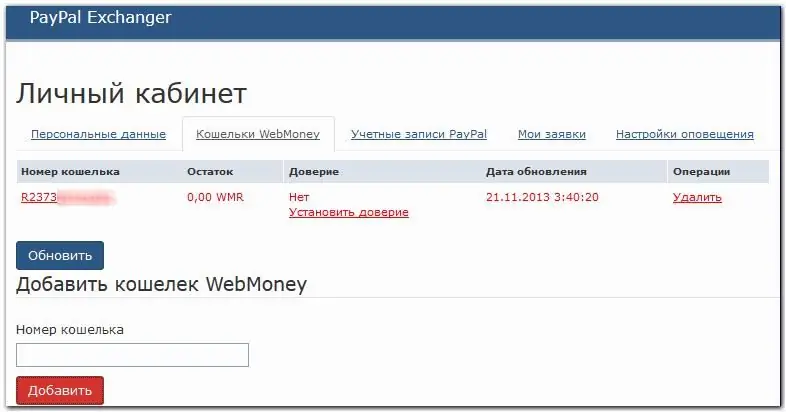

PayPal Exchanger response

When the application is listed, you need to wait for a response from PayPal Exchanger. Exchange options will be offered. They are all reflected in the "My Applications" section. You can choose a counter exchange, then you need to make a transfer from PayPal to Webmoney and vice versa:

- You can learn about the accepted application from the notification.

- Those users who agree to conduct the transaction are visible in the personal account.

- In your WM Keeper account, you can see the invoice that you received from the user.

Further, according to the instructions of the service, the fields for transferring money from a PayPal account are filled in.

Payment method - transaction information

In your WM account, you will be offered options for paying the bill. The fields that appear must be filled in - this will help you complete the transaction faster:

- Select a payment method - if you want to pay with PayPal, select the appropriate icon.

- Next, confirm your billing information.

- Please enter correct PayPal wallet login details.

- There you will see an invoice to pay.

Invoice is issued within 24 hours. If the application was made on weekends (Sunday and Monday), expect the application to be processed on Tuesday. This is the easiest way to transfer money from PayPal to Webmoney.

Certified exchangers: money transfer from one system to another

If the first method does not work, there is an alternative way to transfer money from PayPal to Webmoney. There are authorized and time-tested exchangers like Bestchange. The Russian-language server works according to the principle:

- An order is being created - the currency you want to receive is indicated.

- If you have rubles, then the money will be transferred to WMR.

- On the right, sites through which a transaction is possible will be available.

- The exchange rates are different for everyone, as is the commission.

After making the exchange, check the receipt of funds. Do not use exchangers that do not have a certified Webmoney badge.

Transfer money from PayPal to Qiwi and Webmoney

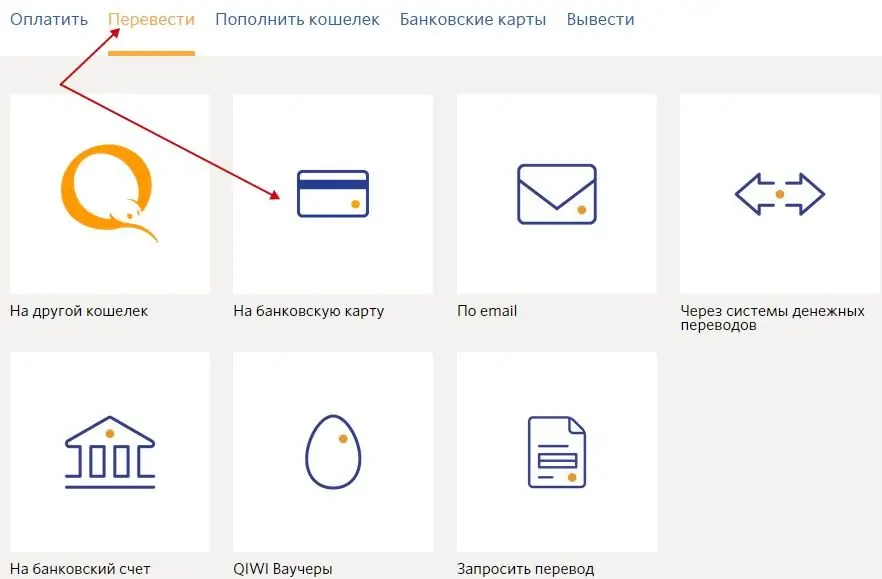

Unfortunately, it's impossible to attach a PayPal account to WM, but it's easy to do through an intermediary. They will be the Qiwi payment system. How to transfer money from PayPal to Webmoney through "Qiwi Wallet":

- First, money is deposited into a single account in the Visa QIWI systemWallet.

- In the "Payment" section, select "Payment systems".

- A window will open in which you need to select the translation function.

- The parameters indicate the WMR account where the funds are transferred.

It's so easy to transfer money from PayPal to Webmoney using an additional Qiwi Wallet. You need to carefully study the commission section: in order to send money to a WM account, you need to pay 5% for replenishing a single wallet, and then another 3% for replenishing your WebMoney account.

If there is no other way out, it is better to use exchangers, which often offer profitable promotions, minimal commission and fast transaction times.

Transfer money via card

PayPal has the ability to link a card. By the way, you can enter the data of any map of the world, to which funds will be withdrawn within a day. In case you need to cash out in the US, just attach a bank account - you will immediately receive cash:

- In other cases, the online banking system works - an invoice is issued to your bank. He pays the commission, and the money goes to his personal card account.

- Further according to the principle of replenishment of the WM account - through payment systems or directly from the card.

- Recall that WM has a card binding function. You can transfer money without leaving your home.

- If the card is not linked, use an ATM to withdraw funds (not cash) and transfer them immediately to your Webmoney account.

- If this is not possible, you canuse the Qiwi system.

- Top up your Qiwi account and update your wallet to see the money in your account.

- Next, in the WM system, you need to create a request for replenishment of your account with Qiwi.

Procedure takes longer. If you send money to online wallets through a card, a large commission is charged. There is no possibility of reverse (counter) replenishment of the account, that is, erroneously sent money cannot be returned through the button in the WM system "Return back". You will have to re-create the application.

The best way is to transfer money without intermediaries using exchangers that both systems work with. But, if you do not know how to transfer money from PayPal to Webmoney with a minimum commission, do not trust exchange offices, do not want to use personal cards, then all that remains is to conduct transactions through additional payment systems, creating applications in each operational service.